(Disclosure: there is no paid content in this blog.)

What’s the Boomer Bust?

We have all heard the Boomer Bust theory: “Vintage sports card values will tank once all the Boomers are gone.” As a claim, it does have some logical appeal: the Boomers are the largest U.S. generation by population. Boomers ushered in the sports card collectibles market as we know it today. They still own a lot of the cards and collectibles. They are aging, and will eventually be gone. Then what?

The reasoning usually proceeds like this: “Boomers’ cards will be passed down to younger generations who have no connection to the hobby, who never saw Mick play, and the cards will be dumped into the market. Supply up, demand down, prices will crash.”

It’s worth noting that people have been contemplating this Boomer Bust since at least 2010, and forecasting 15 years forward to just about . . . now. And here we are at all-time highs, COVID bubble excluded.

So, is the Boomer Bust debunked? Not so fast!

So Many Unknowns

We know that the Internet loves hyperbole. “Engagement!” So as a researcher who isn’t horrible at logic (Philosophy minor in college after all!), I decided to throw some facts into the debate to see if the claims hold true. There is a lot of speculation thrown in for good measure, because there are so many unknowns. A few examples:

· What were Topps print runs in the 1950’s and 1960’s? Nobody knows, but there is a lot of fun sleuthing that suggests that they were very, very high: possibly hundreds of thousands of each card in some series.

· How many of those cards were thrown out by mom or ruined in bicycle spokes? We can never know, but almost every Boomer has a story that involves discarded Mantles and Mays.

· How much unknown high-grade raw vintage remains? Those Boomers love their binder sets, and many of them hate grading. Many of us know, or have heard of, older guys with complete set runs sitting in the basement. Are there thousands of these collections out there? (Probably). Tens of thousands? (Probably not).

And so many more.

Who Are the Boomers?

Let’s start with what we do know. Officially, the Baby Boomers were born between 1946 and 1964. As of 2024, they are either approaching retirement age (60), or right past U.S. life expectancy (78). For what it’s worth, they are also much whiter than subsequent generations: 76%, compared to 62% Gen X (generation stats are from a new book called “Generations” by Jean Twenge–interesting read). The lack of diversity in vintage collecting is a topic for another article, but in part, it is a function of basic demographics.

Despite many having passed away, as of 2021 Boomers still represented a staggering 21% of the United States population. 70 million people. Compare this to Gen X, mostly still alive, at about 18%. There will never be another generation of this size.

How Much Wealth Do Boomers Have?

According to the Federal Reserve, Boomers own about 53% of all net worth in the United States. Let’s keep in mind that many, if not most cards owned by Boomers were not necessarily acquired for retirement planning or investment portfolios, and the bulk of these assets are most likely not even counted in these statistics.

Boomers hold 13.8 trillion in disclosed “other assets,” compared to $5.6t for Gen X. Undisclosed wealth from collectibles is anyone’s guess. But let’s say it is “a lot.”

So, When is this reckoning?

There is a related theory known as The Great Wealth Transfer that predicts that between 2023 and 2045, 84 TRILLION in wealth will be handed down to Gen X and Millennials.

In my view, in 2024, we should already be well into the supposed supply surge. I don’t know about you, but I do plan to eventually sell off parts of my collection to fund my golden years, god willing etc. Every single Boomer is past, at, or nearing retirement age. Many have been there for 12 years or more. Certainly, the selloff is in progress. Perhaps any pent up supply was offset by the COVID boom, and the demand to date has been sufficient to meet the new supply. This seems likely.

But the remaining selloff will take a decade or even two. The Boomer generation spans 18 years (compared to 14 for Gen X and Millennials), so part of the reason for the huge population is that the generation covers a large span of time. In other words, it will be slow and gradual—these collectors have been aging out for a dozen years, and will continue to do so for at least a dozen more.

Further, not all will choose the same route for liquidating their collections. Some have already sold, some are selling now, some will sell later, and some will never sell at all. Of cards that are passed down to the next generation, not all of those folks will sell, either. There are dozens of options in play and they will occur over almost 2 decades. Compare this to the COVID bubble–a true surge, with a clear, sudden cause affecting billions of people at a specific moment in time.

There will be no major Boomer selling “surge”—but there will be a gradual influx of vintage cards to the market, for sure. But there has also been an influx of new buyers post-COVID.

“Who will collect this Stuff?”

The last part of the argument goes like this: “kids today just like Pokemon cards—they don’t collect vintage and don’t even like baseball! We are screwed!”

A few counterpoints:

1. Kids almost never collect vintage. They collect what is current. Most collectors sort of “age into” vintage—in part due to the higher prices of good vintage cards. I collected 1982 as a 9-year-old kid in 1982. I collect 1924 in 2024. This is not uncommon.

2. Is baseball dying? Not really according to most polls like this one. Say what you want, but the pitch clock and other efforts to pick up the pace of play have worked. Viewing among the 18-34 age demographic is up since the introduction of the pitch clock. Youth baseball participation is the highest it has been since 2008. The game is healthy.

3. The game is more and more international and global now—and so is the hobby. The market for modern cards especially has never been larger. In part, thank Shohei. Also, thank the Internet, of course.

4. Cards are now seen as legitimate investments—like fine art and other collectibles. Wealthy folks with no particular interest in baseball or cards now seek and own high end vintage as a way to diversify their holdings. Any investment site now has articles, resources, and /or products devoted to sports cards as an investment class. This might just be a trend–but if so, it is hitting at the right time.

What’s Next? 3 Predictions

Prediction #1: Iconic prewar will always be gold. There were plenty of Babes printed, sure. But the supply of iconic prewar will never meet the demand. Also, the oldest Boomers were born in 1946, and the older the card, the more likely it has already been pushed back into the hobby.

Prediction #2: Late 60’s-early 70’s will falter a bit. If anything suffers, it will be late 1960’s and early 1970’s, with some exceptions. These are the cards that were printed in high numbers; are not as old and thus more likely to be found in solid condition; were collected by the “younger” Boomers who are still 10 years from selling; and are thus still held in massive numbers. These cards could hit the market in something resembling a quiet surge. But . . .

Prediction #3: No Boomer Bust. When we look back on the Boomer Bust theory with hindsight, I bet it will be pretty boring. The Boomers are a big generation, yes–but they are also spread out over almost 2 decades. Some have already sold out; surely some cashed in on the COVID bubble; some are selling now; some will sell later; and yes, some will leave cards to their Gen X “kids.” Due to all of these possibilities that will play out over the next 15 years (and have already been playing out over the last 10), a true “Bust” seems highly unlikely, if not impossible.

If you enjoy chatting Vintage, please Join Cardhound and come hang out in our Forums!

Excellent topic, excellent take. I, too, collected 1980 Topps in 1980, but now collect 1922 E120 in 2024. The sky is not falling, and the world will keep turning after the Boomers are gone…

Fun read. I often wonder about this. Simply hoping my son who loves baseball will also continue to love my cards when I’m gone. Collecting, whether we admit it or not, is always tied to value but I hope that is true only to a lesser extent vs loving the artifacts of baseball and their preservation.

I often hear the point that “kids today are not fans” the way we used to be. But nothing is the way it used to be. I think it’s “old man yells at cloud” syndrome, mostly. But there are some valid concerns.

Tangent: I don’t love that collecting modern has become about “hits” and values and gambling. Even SPORTS has become less about fandom and more about gambling (it’s everywhere). So then you end up rooting for Taylor Swift to wear a green sweater on the day that Ohtani hits a triple to beat your home team in extra innings so you can hit your trifecta. It’s kinda sad.

But I do think that sports and collectibles will endure, just because they are woven into the fabric of our culture–and that is only spreading at the global level.

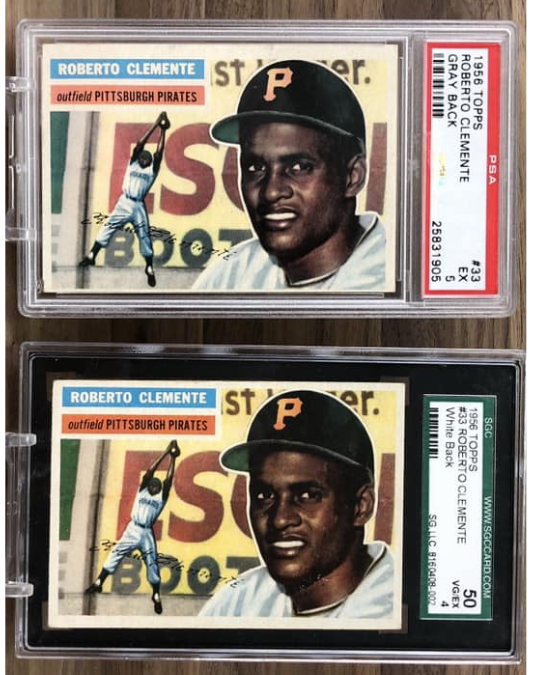

The blue chip guys like mantle, mays, Clemente, koufax will thrive. The Kaline, Killebrew, snider class of HOF will fall down further.

The farther we get from the glory days, you are probably right–but I’m not sure this is Boomer-related, its just what happens over time. There are some prewar legends you can get cheap. History tends to remember the GOATS.

As Gen X with Boomer dad, I was able to convince him to pass his 1950s and 1960s cards onto me. So while I will certainty sell some of them into the market, I will be keeping others as well

Well written and insightful article,Matt…I think vintage will always hold a solid place in the hobby and as evidenced by the price of Ruth cards(even though no boomers saw him play) old cardboard will continue to rise in value…as for the new manufactured 1 of 1’s(and it appears there are millions of them) I have my doubts they will be worth what they are selling for today

Good stuff. I won’t be mad if prices come down, but I don’t consider my cards investments. Our grandson is really into modern football cards, but that doesn’t stop me from talking old-time baseball with him whenever I can. He knows a bit abt my collection. I try to meet him where he is now (buying modern) to engage with him — all in hopes of him gaining a greater appreciation as he gets older.

Boomer here! In my opinion trying to apply logic to the hobby future, though interesting, is just opinion/speculation. No one from my generation bought baseball cards as investments but strictly for the love of the game. Grading came along well after and changed the dynamics of collecting quickly collecting turned into investing. As I reached the time in life with discretionary income I was fully aware that my purchases had to make economic sense. I see this in the 30-40 age group now coming into the higher earning years. I have several nephews that love collecting baseball cards but every purchase is based on if the card has future upside. They pretty much only buy graded cards. Maybe that’s the future, where raw cards are only for my generation. That in itself is a problem because, like my collection, I’ll bet many boomers have many raw cards of high value. What happens if the only way to sell is to have them graded and the grading companies want a part of your equity? Can boomers afford to layout that kind of money? Or do they even want to go through the effort? In this scenario I think many collections will be left to heirs. Trust me the heirs will know there is value their and not dump them on the market for peanuts.

Bottom line, I believe there will always be a market for baseball cards but like any collectible the market will fluctuate and the more affluent will be the buyers.

Thanks for a good read, Matt.

You make excellent points and observations. As a Boomer, I didn’t have an investment strategy when I was 8 years old, I just bought a pack of cards every time I got 5 cents. I love to see how card collecting has evolved and hope it continues to engage more people.