I have been closely following SGC news since they were acquired by PSA parent company Collectors. An SGC loyalist, I had early optimism that SGC might be repositioned as a vintage-only boutique-type grader. Frankly, that would just represent a return to pre-COVID business as usual. But in this Vintage Grading Report, we are confronted with hard data that might signal the end of an era for the SGC brand.

The softer take is that it represents a quick “transition” to a “boutique grader” status that is so far undefined. I hope for this latter option, as my entire personal collection is in SGC plastic. I prefer their service, aesthetic, and most importantly, grade quality to any other company. But in any case, it is clear that the future for SGC will look very different from the recent past we are accustomed to.

Since the acquisition, the news has gone from bad to worse. Popular SGC President Peter Steinberg resigned. PSA moved into the same building as SGC HQ in Boca Raton, Florida. SGC discontinued bulk submitter rates. PSA began cross-training SGC employees. The list goes on.

And given the developments since Cardhound’s June report Grading Shake-Up and the Future of SGC, I’m finally ready to admit concern for the future. One popular opinion is that Collectors seems intent on running SGC into the ground and folding both their physical and human resources into expanding PSA’s market share and card processing capacity. It’s hard to make any other case at the moment, absent a convincing statement to the contrary by PSA’s Ryan Hoge. I still hold out hope that an SGC “rebrand” is forthcoming, but time will tell.

SGC Volume in Tailspin

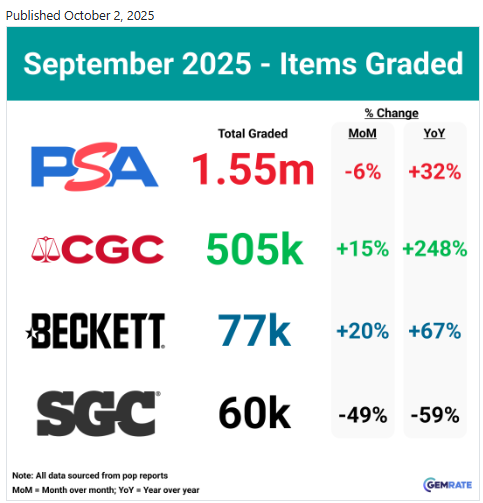

Think I’m overreacting? Well, let’s take a look at Gemrate’s September card grading data:

You read that right–SGC processed fewer cards than Beckett last month! And as we have detailed in the past, Beckett is also clearly on life support. Notably, SGC still handily outperformed Beckett for sports–Beckett is now primarily a Pokemon grader, and SGC has almost no market there. SGC’s employees have reportedly been retraining for handling of PSA orders.

A Look at Vintage

In recent months, SGC had actually outperformed PSA in vintage market share. As recently as July, Cardhound documented that SGC had taken over the top spot for vintage! That was a remarkable feat, considering the nearly 10 to 1 market share otherwise. That data bolstered my opinion that PSA and SGC would coexist, with PSA conceding vintage share to SGC–especially prewar, leaving consumers with choices.

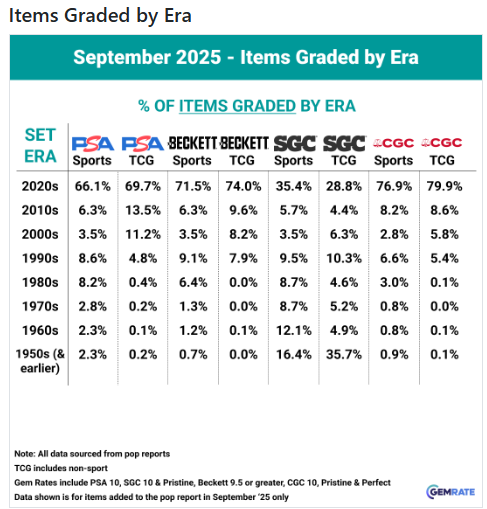

But let’s look at this sudden turn of events:

While 1960’s and earlier still represents a large share of SGC’s business, the volume decline is unprecedented. Based on the number of sports items graded (714k for PSA and 56k for SGC), this means that:

- PSA graded 33,000 cards 1960’s and earlier last month

- SGC graded 16,000 cards 1960’s and earlier last month

In previous recent months, SGC was actually grading more vintage cards than PSA. In June 2025:

1950’s and earlier represented 2.6% of PSA’s sports volume = 13,650 cards graded

1950’s and earlier represented 12.2% of SGC’s sports volume = 17,880 cards graded

SGC also graded more sports cards from the 1960’s than PSA as recently as June. So in short, SGC was a 50 / 50 competitor for vintage sports, just 2 months ago.

So in the span of a couple of months, SGC has been transitioned from viable competition for PSA in vintage, to nearly an afterthought. Amazing, and sad. Even if you are a PSA collector, if you are a vintage specialist, the loss of competition in this space is not a positive development.

What’s Next?

Admittedly, I’m still digesting this information. I suspected SGC would be “down,” but not like this. I’ll surely write a follow-up after talking to some insiders, and will be pondering questions such as:

- Is the intention to shutter SGC? When?

- If not, will SGC be explicitly repositioned in some way (vintage only, etc.)? When?

- Does SGC’s shrinkage open doors for CGC and Beckett in vintage?

- Will SGC’s share just slide over quietly to PSA? (Something most SGC collectors like me said would never happen)

Your thoughts and opinions are welcome in the Comments and this article will be updated as new information comes available.

I left SGC for CGC just in time. I just had the feeling Peter was not sticking around and Collectors was just purchasing them to fend off Fanatics from doing it. There’s a lot more going to happen in my opinion. Go CGC Go!

Very Disappointing as I liked the fast turnaround, pricing and slab style black background. Already noticed a slow down as I have a submission in right now and is taking longer than previous. The sad thing is it will slowdown submissions even more and less competition could cause a monopoly and drive the others out as most already praise PSA at the top causing higher prices for submissions than what is already there. Maybe they will branch off as you stated to vintage only, or one of the other companies will see and opening to vintage and go that route as I’m all about the old stuff.

I hope SGC survives and worry that it will turn out to be like a run on a bank – meaning that people will switch to a different grader because they are worried that SGC won’t be around long term, which could help make that the reality.