Per multiple sources, PSA parent company Collectors has reached an agreement to buy Beckett Grading.

Similar to when a deal was reached to purchase SGC this past February, PSA’s claim is that Beckett will remain an independent brand. With some hindsight, it is questionable whether that is Collectors’ true intention with SGC. Beckett’s future will be interesting to watch.

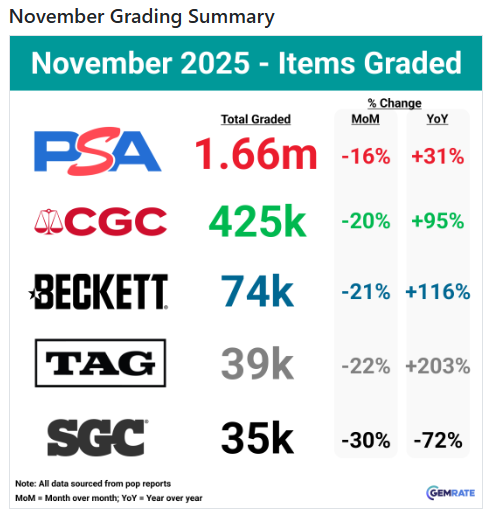

Notably, Becket has been gaining some market share recently, in the wake of SGC’s forced slowdown as PSA has retrained former SGC employees.

“I am pleased to share that the iconic Beckett is joining the Collectors family and will continue to operate as its own independent brand within our portfolio,” Nat Turner, CEO of Collectors, said in a statement.

“The first card I ever submitted for grading was to Beckett, and I consider Collectors custodians of this important icon in the hobby. We believe that strong, well-supported brands help grow access to the hobby.”

Cardhound speculated on Beckett’s future here, given that their most recent owner, Collectivus Holdings, was clearly a stopgap. Funding for Collectivus was backed by King Street Capital Management. A little Googling shows that King Street is in the business of “special situations investing,” “providing financing to companies that require flexible, non-traditional capital due to lack of/uncertainty of near-term cash flows and/or structural market challenges, as well as stressed or distressed rescue financing.” Beckett was most definitely distressed and seemed unlikely to survive alone, despite recent gains.

This leaves CGC as the only other major player in collectibles grading. I’m no antitrust expert, but I do wonder whether this transaction will receive any legal attention along those lines.

This story will be updated as more details become available.

Monopoly! Who’s next?

Who’s LEFT??

Sure hate to see consolidation among the players. That is not good for the hobby