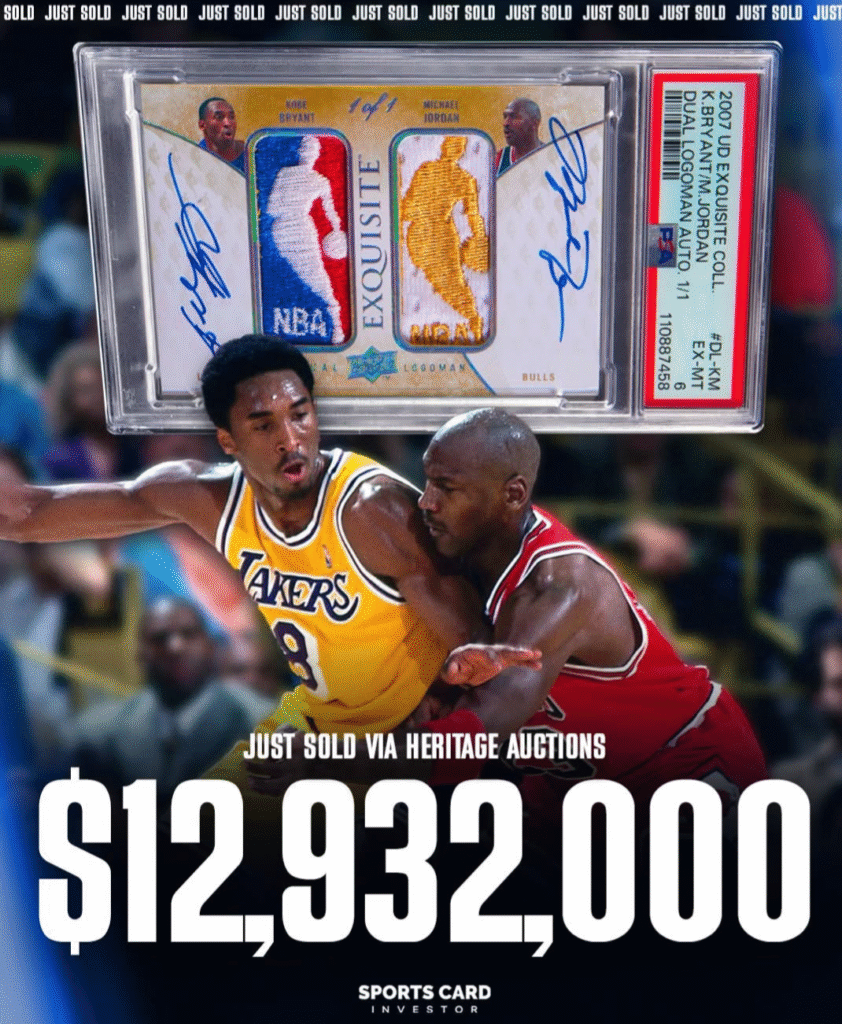

You have likely heard by now: there’s a new king of sports cards. Well, 2 kings actually: Koby and MJ. Their 2007 UD Exquisite Dual Logoman 1/1 just sold to an investment group that includes “Mr. Wonderful,” Kevin O’Leary and others. The Heritage sale grossed $12.9 million after the buyer’s premium. This continues a trend of record-setting sports card auctions that has no clear end in sight.

This displaces a 2022 sale of a famous 1952 Topps Mickey Mantle card, graded SGC 9.5 and considered the “finest known example” of the iconic rookie card. That card sold for a then-record-breaking $12.6 million at a Heritage Auctions in September 2022, making it the most expensive piece of sports memorabilia ever sold at the time. The card, once owned by Anthony Giordano, was previously purchased for a modest $50,000 in 1991 and was featured as part of the “Rosen Find,” a significant discovery of vintage cards.

(Photo credit: Sports Card Investor)

High Grade Vintage Continues Record Pace

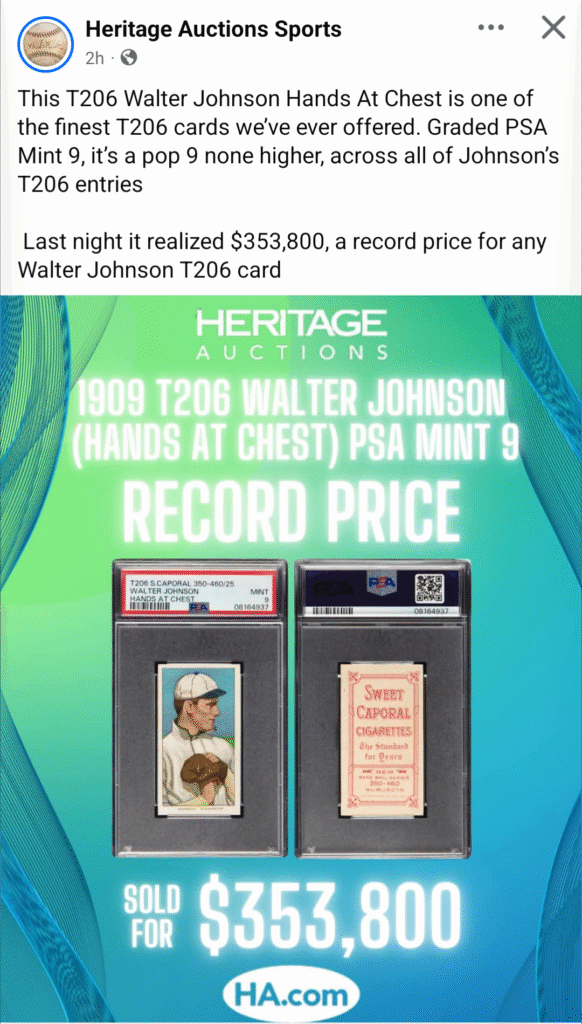

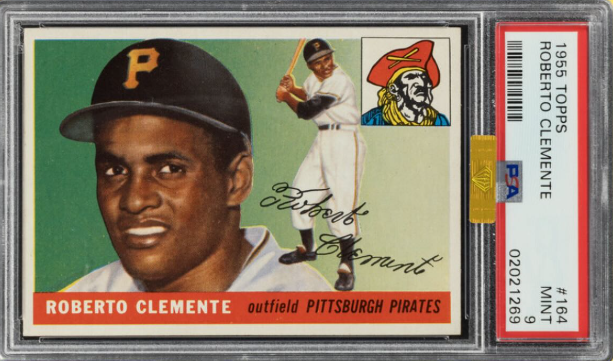

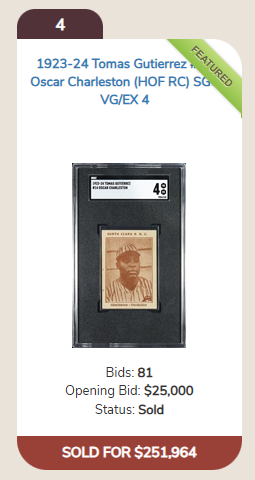

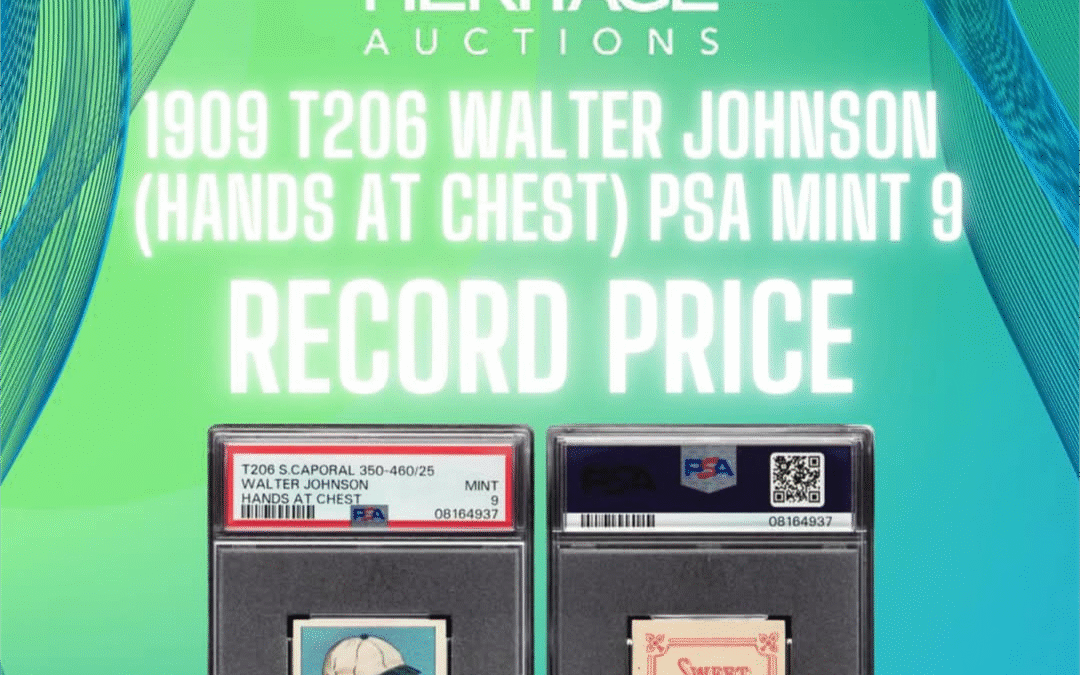

And it’s not just ultra high-profile cards breaking records. High-grade low-pop vintage continues to break records. This T206 WaJo in PSA 9 also broke a record. As did a recent Clemente rookie and even a rare card of Negro League legend Oscar Charleston.

How’s the Market?

So, “how’s the market?” I get this question several times per week, and there’s just no single answer for it. “Which market?” is my usual response. But how many “markets” are there? After all, I will never compete in a bidding war with Mr. Wonderful. Does the ultra-high-end market reflect “the hobby” in a useful way? Is Mr. Wonderful a “hobbyist” now? Or have some cards entered into a different investment class, distinct from 99.9% of other sales?

The “celebrity / billionaire / conglomerate” buyer is nothing new. Gretzky bought a Wagner in 1991 for $450k, a record for any sports collectible at the time. Ken Kendrick (Diamondbacks owner), “Vegas Dave,” and others have all made their splash.

But what impact or relevance do these sales have on “the hobby” in general, if any? And just how many “markets” are there, anyway? Maybe it doesn’t matter much, but as someone who follows and writes about the hobby constantly, this is the kind of stuff that keeps me up at night.

Not all collectors even participate in the high auction scene–and of those who do, the segment bidding and buying 6-figure cards (much less 8-figure cards) is tiny. I write regular “market reports” and here are some of the factors I think through when analyzing the raw data from many sources, including the Cardhound Vintage 100 Index hosted by Market Movers.

Broad Market Segments

So how many vintage markets are there? And how can we define them? Personally, I’m most invested (literally and otherwise) in the “hobbyist” category below. But likely, if you care enough to read this far, you will identify yourself in many of the following possible segments. I’ll propose a definition below that I bet captures a vast majority of vintage hobby transactions.

End Users

Verified Market Reports categorizes the collectibles market by “End-User Segments” as follows:

- Hobbyists – Collect for passion, nostalgia, or fandom (often forming the largest share)

- Investors – View cards as financial assets for long-term appreciation

- Casual Buyers – Purchase occasionally, drawn by trends or special releases

You might be both a hobbyist and an investor–I think of myself as both. But I’ll go out on a limb and say that Mr. Wonderful is just an investor.

Collector Personas

Other sources categorize the card market by “collector personas.” What’s the motivation for being in the hobby in the first place? Richard Blankman proposes a framework identifying buyer archetypes—and many sports card collectors overlap between these:

- The Flipper – Buys low, resells higher for profit (often quick turnover)

- The Personal Collector – Driven by affinity for players, teams, or eras

- The Investor – Focuses on cards expected to grow in value

- The Competitive Collector – Strategizes like a stock market or fantasy sports: predicting star potential, buying early, and acting on outcomes

Personally, I can identify with 1-3 above, but #4 seems like a modern card trend. I would also add “the gambler” in here somewhere, distinct from the flipper and the competitor.

Demographics

Lastly, we can turn to more traditional demographics, as outlined by 360iResearch. Not all apply to vintage, of course.

Age & Income

- Children (5–12) – Young fans, often collecting themed player or starter sets–more TCG than sports

- Teens (13–19) – Drawn by social engagement and online trading–more TCG than sports

- Young Adults (20–35) – Major participant group in modern collecting, blending investment with nostalgia and fandom

- Middle-Aged & Seniors (36+) – Most vintage buyers; often nostalgia-driven collectors or high-value investors

- High-Income Collectors – Seek ultrarare cards, regardless of era, as both status pieces and investments

For vintage, “middle-aged” + high income are obviously the prevailing markets.

By Motivation & Behavior

- Nostalgia Seekers – Driven by memories or the charm of vintage cards

- Competitive / Strategic Buyers – Actively predict trends or star performances (modern speculators)

- Community Builders / Traders – Use cards as social currency—trade at shows, online forums, or conventions

#1 and #3 both speak to me as a vintage guy.

Market Behavior & Engagement Mode

- Online Shoppers – More than 60% of buyers favor digital platforms but most collectors do not participate in major auctions

- Offline Buyers – Prefer card shops, conventions and shows, and in-person vetting

- Beginners / Intermediates / Advanced Collectors – Varying expertise levels, ranging from casual to pro dealers

I’ll buy anywhere and everywhere–so I guess I’ll just call myself “advanced.”

Understanding Vintage Markets

Once we get past the million and multi-million-dollar investment purchases, and also weed out the casuals, I think that the vast majority of vintage card collecting–“the vintage market”–can be categorized as follows:

“Middle-aged, nostalgia-seeking, more-than-median-income hobbyists who love collecting for its own sake and who also consider long-term value and investment implications of their bigger purchases.”

That’s a mouthful but I’ll bet that captures 90% of hobby activity. Agree? Disagree?

These are the folks who will be in the hobby even after the trend of record-setting sports card auctions subsides–if it ever does.

You nailed it. This is definitely me: “Middle-aged, nostalgia-seeking, more-than-median-income hobbyists who love collecting for its own sake and who also consider long-term value and investment implications of their bigger purchases.”