So, what’s in store for card grading in 2026? Now that Collectors own PSA, SGC, and Beckett, will the latter 2 survive and thrive going forward? Will antitrust inquiries amount to anything? Can SGC rebuild–and is that even the plan? Who knows, but let’s look at some data and discuss.

As a vintage collector with only SGC slabs, I have of course been following the recent developments. Personally, I’ll be on a grading holiday from SGC until / unless they pull themselves together. With turn times 2x-3x the advertised 15-20 business days, and volume so low, I just don’t have full confidence or trust in the process currently. I’m not defecting to another brand–just pumping the brakes on submissions.

For example, I’m currently on day 5 of a 1-2 day express (expensive) order, and going on 2 months for other orders in process. I know the staff on hand are doing their best, but I just can’t get a read on Collectors’ true intentions for the SGC brand, despite recent statements (below).

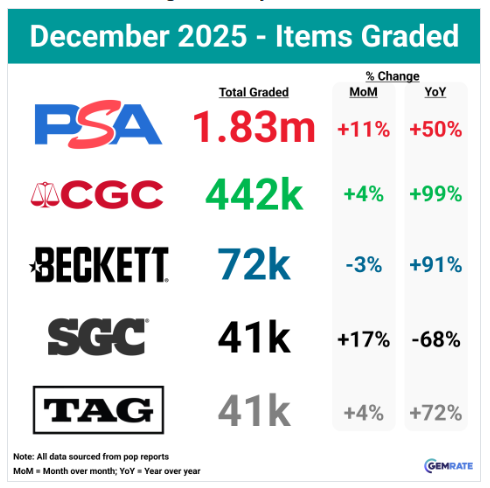

Dec. 2025 Grading Stats

And speaking of volume–which has been on decline for months at SGC–the year wrapped up with mixed signals (per Gemrate).

While SGC ramped up a bit from November, the year over year is obviously the major concern. TAG grading and several other alphabet soup names (not tracked by Gemrate) are in the mix for that tiny crumb of market share not owned by PSA or CGC. Granted, most of those lesser names are grading TCG almost entirely–and TAG doesn’t grade vintage at all.

But the month over month gain might suggest the beginning of a gradual rebuild after many SGC graders were reportedly moved over to the PSA side in Boca Raton.

PSA Podcast: The Year Ahead in Grading

The newest episode of the PSA podcast is worth a listen:

While Collectors continues to claim that PSA, SGC, and Beckett will operate as independent brands, excuse some skepticism due to the facts that:

- Hoge is the grading president of all 3 brands and

- We need to listen to the PSA podcast to learn about the futures of SGC and Beckett.

Clearly, the three brands are not on equal footing. It’s PSA and then the other guys–which is maybe defensible. But it would be best if SGC and Beckett got their own podcasts on which to share their own news, yes?

One topic not addressed in the podcast is the potential for antitrust investigation after Congressman Pat Ryan’s (NY) letter to the FTC. I’ll continue to track that story if it evolves beyond the initial letter.

But some takeaways from the podcast might help us predict what 2026 could bring:

- Hoge broadly mentions leveraging information and technology across all 3 brands (brand protection, anti fraud measures).

- Beckett’s black label 10 and SGC’s “vintage prowess” are mentioned as unique and important features of each individual brand.

- Increasing capacity for all 3 units–all of which are currently running behind stated estimates–is a stated focus.

SGC Specifics

Hoge opens the discussion of SGC by saying “awesome brand, awesome team.” He states that vintage is making up a greater percentage of SGC’s submissions (an interesting claim since historically SGC grades mostly vintage and never made serious inroads into TCG or ultramodern). This is cited as the reason for the slowdown–he states that vintage takes longer to grade.

There’s no mention of PSA reportedly taking most of SGC’s staff–which would obviously also slow down turn times. And this is what bugs me about Hoge’s communications: there’s always something that’s a bit disingenuous, and that makes me doubt the sincerity of the entire message. But that’s an aside.

Regarding turnaround times, “Q2 and into summer” is mentioned as a date where we might begin to see faster returns.

SGC “doubling down on vintage” is also mentioned for 2026. But personally I have seen no particular focus on vintage from SGC, and in fact their recent social media still leans mostly modern. For example, 8 of the last 10 SGC posts on Facebook feature modern cards, as does their splash image on Facebook. If there’s going to be a doubling down, that’s future tense. And it would be a welcome move–and curious that they did not clarify this immediately after the acquisition.

2026 Predictions: Optimist’s Version

Admittedly, I don’t do optimism well. But if we take Hoge at his word, here’s what we might see across the Collectors landscape for 2026:

- PSA: Expanded capacity and decreased turn times, and an expansion of the global footprint.

- SGC: A replenished staff, a more cohesive vintage focus, and decreased turnaround times.

- Beckett: A revitalization of the brand–including new labels and visual updates–sooner than later. Adding imaging to Beckett’s process–which is and should be standard service.

- SGC / Beckett: Direct access to vault /eBay selling services later in 2026–this could be a boon to both brands.

- All 3: Knowledge sharing across all 3 brands about counterfeits, fraud, theft, etc. Also, lots of pop report “clean-up” and deactivation of dead cert numbers across the ecosystem.

Your assignment is to remind me about this article in June and December so we can check in and reevaluate!

Excellent recap of 2026 Vision / Prediction !!!

If each brand would just look to implement whatever is needed to deliver, how you stated it, I would increase submissions to SGC with increased confidence and begin to sumbit to Psa.

This shouldn’t be that difficult but when driven by $$’s then decisions are made that are not in the best interest of the collector or person submitting. Greg piece Matt !!

Great recap of 2026 vision!

As an SGC submitter. I question the optics regarding conflicts of interest. Ryan Hoge is President of PSA, SGC and Beckett. SGC was a major threat to PSA’s market share. The acquisition of Beckett came after a content creator was seemingly skimmed off his profits after pre-selling his 11 Pokemon (which supposedly graded 9) cards. However, they were later graded 10s and the mistake was due to a memo/communication error. I want to know that SGC will still be autonomous and not be gradually phased out of operation over the near future.

It would be ideal if Collectors would give each company its own mission. PSA as a catch all, Beckett as TCG and SGC as vintage. Allow the customer to have the option of PSA or the other for any transaction. Through the market demand and submission define how Collectors should align each company. Don’t just close them because they were superior in some way. Instead they should capitalize on the loyalties we all have to one brand or the other.

Agree–a cohesive plan for each brand is needed, sooner than later for SGC and Beckett.

I see a slight bounce back, but still not where we were a few years ago. Turnaround times might improve, but I’m not sure the companies will be able to hold it if they have an influx of submissions because of the early improvements. They need more staff and more consistent decisions across the board.

I would like to see all of the graders have the ability to add comments on why they may have taken off some ratings points on the grading process. I know they can’t add a lot but it’d be nice to know what exactly they’re looking at.

You DO get grader notes at PSA at some tiers of submission–but it would be a nice standard service. Give that they currently spend about 1 minute per card though, it’s not likely!

I love the look of vintage in a tux. I hope they turn it around too. The entire process is still nerve-wracking to me. I’m thinking about just buying graded cards to avoid the process entirely.

I love the SGC presentation and would hope they continue to focus on vintage cards

Subjectively is far too prevalent in grading. Period.

I love my SGC graded vintage. Keep SHc!

SGC

Since my earlier comment was unapproved, I’ll give it another shot.

PSA has always been the leader in card and memorabilia grading. Their slabs normally bring higher prices to sellers.

However, it appears now that the PSA goal is to swallow up any and all competition—monopoly—begs the question of legality.

2026 will bring an unease in collectors that really hurts the hobby. Personally I think the door is open for a possible newbie to garner some submissions. I certainly hope so.

It was approved–just took me a while. First-time commenters need to be manually approved because I get about 20 SPAM comment attempts per day.

Thanks for all this. It’s refreshing to get an honest opinion from someone who’s “invested” in vintage cards. As an exclusively-vintage collector, with friends who are exclusively-vintage collectors, I really appreciate your experience and insights. As you recommend, I will take Hoge at his word (is there any other attractive alternative?) and wait and see where we are later this year.

I think the government will finally step in and create some serious oversight. We have officially entered into monopoly or at least oligopoly as far as the consolidation goes. Grading is about to get a whole lot more stringent.

I think PSA (um, I mean Collectors) realized that tanking SGC was a bad idea, especially with CGC coming on the scene and making some inroads. CGC will continue to grow and I think SGC will grow again, as well. Not sure what to say about Beckett; I was never a huge fan. Maybe they’ll bring back BCCG to confuse the new collectors again. Haha

He must have a plan, but he sure isn’t sharing it. PSA has historically drawn better price return but they’ve all but flipped completely to modern non-sports cards and seem to have raided SGC’s operations. I don’t understand how they’re going to position Beckett if they plan to keep all 3 agencies and revitalize SGC and Beckett. All my stuff is vintage, so I hope it’s SGC getting back on its feet for the future but like you, I don’t think Hoge is telling us anything we can really read.

As many do, I prefer the SGC look. However due to the notes recent events And because of PSAs set registry, I’ve been converting some of my core PC to PSA. Not thrilled about this but I’m trying to look out for my family when the time comes to pass down/sell and the hopeful ease PSA graded cards will bring. PSAs recent alleged scandals though are giving me overall pause. I think 2026 will be a wait and see game for me. My prediction for 2026 overall is Collectors gets hit with a lot of legal battles for monopoly etc. CGC picks up sports card market share.

I’ve been a fan of SGC for their vintage specialization and (IMO) the best looking slabs. But I am also sitting on a grade pile that I’m very hesitant to submit and feeling pessimistic about the future of grading. Aside from resources being siphoned over to PSA, with it goes vintage expertise. So even if turn times and customer service return to previous levels, I still worry about grading quality. I’d love to see a vintage boutique alternative to the PSA conglomerates (perhaps a collector-owned coop).

I’m right there with you though I did bite the bullet and submit recently. The regular order (“15-20 business days”) looks like closer to 40 business days (2 full months).

Much of my vintage collection is SGC graded, but I now prefer PSA. A big factor for me has been the wait time, but if things can be streamlined a bit, I may choose to split my grading requests based on how I see the card grading with each. Maybe I give Beckett a try?

I would not be surprised to see them combine SGC and Beckett into one unit taking the best features of each company to form one formidable division.

Great piece Matt. They all need to go back to putting the customer/ submitter first. Work on those customer satisfaction areas and things would improve for all.

I wonder if they are close to a COVID-era backlog situation–might be best to pause SGC and Beckett while they get their respective acts together.

I believe AI is the way to go.

Logical to think it is the “future,” but AI needs to overcome the entire “legacy” of 2 decades of human-graded cards. Tough hill to climb.

TCG is the wild card here. I don’t collect or follow TCG, but it accounts for the bulk of grading submissions to PSA, CGC, and Beckett. That’s where the bulk of their resources go. Improving TCG grading processes will enable faster processing times for sports cards, which realistically account for roughly 1/3 of their total submissions or less.

That said… my predictions:

– PSA will continue to be the undisputed lead for resale and the default grading option for resellers and those who use the PSA registry as their collection’s focal point. But the average hobbyist is getting frustrated with PSA and their high prices, low grading times, up charges, lack of transparency, and the stranglehold they have on the industry.

– SGC will get a little more breathing room from Collectors, and will hopefully be revitalized. They have a huge following among vintage card collectors, most of whom feel put off by the way Collectors has decimated SGC in recent months. If Collectors wants them to be a boutique grading company, they should streamline which cards they grade (for example, only accept submissions for cards made before 1980 or 2000). Or they could stop accepting TCG. Find the 80/20 and focus on that. And bring back their formerly top-notch customer service.

– BGS was a broken company, and this is a massive opportunity to breathe life into the brand. Very few hobbyists that I know use BGS as a first grading option. It’s usually for certain thick cards (relics and similar) or cheap autograph authentication. There is a huge opportunity to improve the slabs and the slab flashes. If they want to turn BGS into a cash cow, they should revitalize the slabs, then change the 9.5 to a 10, and allow hobbyists to send in their 9.5s to be upgraded to 10s in the new slabs. Charge $15 a slab, and they would be backed up for months. They would print money.

– CGC has a lot of opportunity to gain market share, and I predict they will continue to grow in 2026. Their slabs are crystal clear and attractive. Their resale value is less than PSA and vintage cards in SGC slabs. However, I find their grading to be consistent and on par with the big grading companies. I cracked a Tony Dorsett rookie card from a CGC 5 slab, sent it out for an autograph, then had it graded by PSA, and it came back as a PSA 6, Auto 10. CGC buying JSA was a huge acquisition, and it gives CGC the full stack for grading and autograph authentication. Thankfully, this gives hobbyists another option outside of the Collectors umbrella. I think more hobbyists will use CGC in the coming year, and with wider adoption will come wider acceptance and greater resale value. That will be the self-sustaining flywheel that will drive more submissions. At the end of the day, hobbyists and resellers are concerned about preservation, authentication, and value. The better that CGC does this, the more frequently hobbyists will use them.

**I’m a big fan of dual-graded autographed cards through CGC. I submitted over 200 cards to CGCxJSA last year (many for resale to help fund my personal collection). I love their slabs and I find that the resale value is on par with autographed cards in BGS slabs, and can be comparable for some lower-end PSA cards. I still use PSA for higher-value signed cards. But I no longer perceive PSA as the default option.

Hey you should start writing for Cardhound! : ) I’m with you on all of this btw. Including CGC / JSA.

I agree with Ryan’s synopsis.

Since my earlier comments are obviously still in moderation feel free to simply ignore them.

I’m a layman about such matters, but as a vintage card collector, I think the confusing MoM and yearly data are confusing and contradictory in some sense. That uncertainty means more growth for the big three, in my opinion. And I think leveraging of information and technology is inevitable and necessary.

I love SGC love the tux. But my last 1-2 day submission took 3 weeks. I have a few autos id like to send to CGC but I guess im waiting to see if they get taken seriously resale-wise. Id like to see CGC become a substantial competitor to psa.

I’ve found that using Boca Card Subs cuts out all of that time when your package is just waiting to be “received” (opened) at SGC. They are still pushing out Express on time, mostly.

I believe use of AI would alleviate many of the issues that exist today.

I’m definitely not feeling optimistic about the near-term future of grading. I’ve been a big fan of SGC both for their vintage expertise and attractive slabs. But like the author, I have a grade pile that I’m hesitant to send in. Whether or not Collectors reinvests in SGC, I worry that siphoning off resources to PSA has not just affected service and turn-around times, but marks a brain drain of talented and experienced graders. So whether or not they get back on track with service, I’m concerned about quality.

Given CGC’s strategic partnerships, perhaps they’re poised to carve into Collectors’ market share. Regardless, fewer independent options and a near monopoly by Collectors does not bode well for the hobbyist. Even if CGC gains traction and additional clout with slabs that rival PSA’s in value, I can’t imagine how customer service does not continually decline in this environment. Personally, as a vintage collector, what I’d love to see emerge is a member-owned boutique grader co-op focused exclusively on vintage.

I hope what he says is true and would love to see SGC bounce back but I have my doubts. I’ve recently done a few submissions with CGC to test them out and have been impressed with their times and think the slabs are really attractive. That’s where my focus will be until I see improvements elsewhere.

I hope that Beckett just gets retired as a brand new I love SGC and it would be great if it becomes the vintage brand. PSA will remain king. However, I am going to shift over the CGC. They have the resources, the credibility, and the momentum to keep growing as a great option.

PSA will still be the top dog for a long time.

I see PSA continuing to lead the way in submissions and resale, although I also envision collector’s frustrations with them also not changing. I’d like them to take on sub grades or more clear explanation as to why the grades are given. I’d like for hobbyists to think more about quality submissions, instead of quantity submissions. If SGC can somehow retain hold of the vintage market, I will still use their services, but for now I’m not submitting to anyone.

CGC will spike in early 2026 with collectors tired of waiting longer to be a part of the psa monopoly. The weird reports coming out on psa in the past year leaves a bad taste in collectors mouths. There are enough collectors wanting to stand up to the monopoly of the future and I think CGC will be the platform to unite on, ifCGC can capitalize in Q1 and make it easy.

As much as I want the non-psa companies to gain respect equal to PSA from a comps perspective, I don’t think we’re gonna see that, at least not in 2026. It’s unfortunate how you are forced to choose between a good grading experience (fair grading, fair pricing, reasonable turnaround times) and card value. Hopefully this turns around soon.